Business Overview

(Real estate collective investment scheme)?

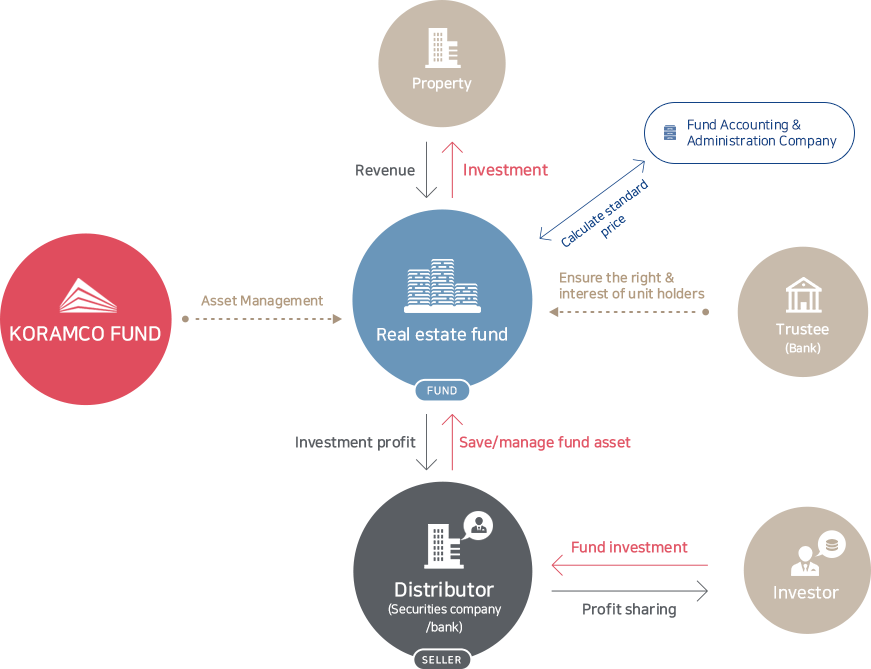

It is a product investing to "real estate, real estate related rights, real estate related asset" exceeding 50% of fund asset(collective investment asset) and distributing the generated pofit to investors.

KORAMCO FIRSTEP Yongsan Hotel Private equity real estate investment trust No.10

Through real estate funds, customers entrust their investment funds to asset

management

specialists and, thereby, invest in rights and assets relating to real estate.

![]()

![]()

![]()

Koramco Fund strives for continuous, stable profits.

It refers to "Buy&Lease real estate fund" aiming to secure the sales margin based on increase of future real setate value and stable rent profit. Major management method is to purchase and lease out office real estate(office building) or commercial real estate(shopping quarters).

It refers to "value investment real estate fund" which usually perchase office real estate of commercial real estate in low price through court action or public sale by asset management company or finacial institutions to lease out or sell for rent profint or sales margin.

It refers to real estate find investing on derivatives with real setate as based asset.

It refers to "project financing real estate fund" which manages loan related to corporate in real estate development business(hereafter developer), and aiming to receive loan interest frome developers.

It refers to "development method real estate fund" acquiring development profit through distribution or lease through directly promoting real setate development business by fund playing its role as director.

It refers to fund investing in trust related profit rights, mortgage-backed monetary claim, real estate fund(collective investment) securities.

It refers to fund investing in REITs share, PFV issued securities, equity security issued by real estate investment purpose company.

Public offering raises capital publicly from various investors.

According to the Capital Market Law, public offering must raise funds from no less than 50

investors.

Stable investment by avoiding various risks associated with direct investment in real estate

Anyone can make small investment in various sizes and forms of real estate.

Save taxes that incur as a result of directly owning real estate, such as acquisition tax, property tax, and comprehensive real estate tax.